Strata:G® Case Study - Service Business

Bookkeeper + Owner of Auto Care Business

I’m the outside bookkeeper for Local Auto Care, a mid-sized repair and maintenance shop. The owner had pulled together a rough budget for the next year.

Rather than just reviewing it on paper, we sat down together and used the Strata:G® Calculator for Service Businesses to test it — and more importantly, to see what would happen to both profit and cash flow if some changes were made.

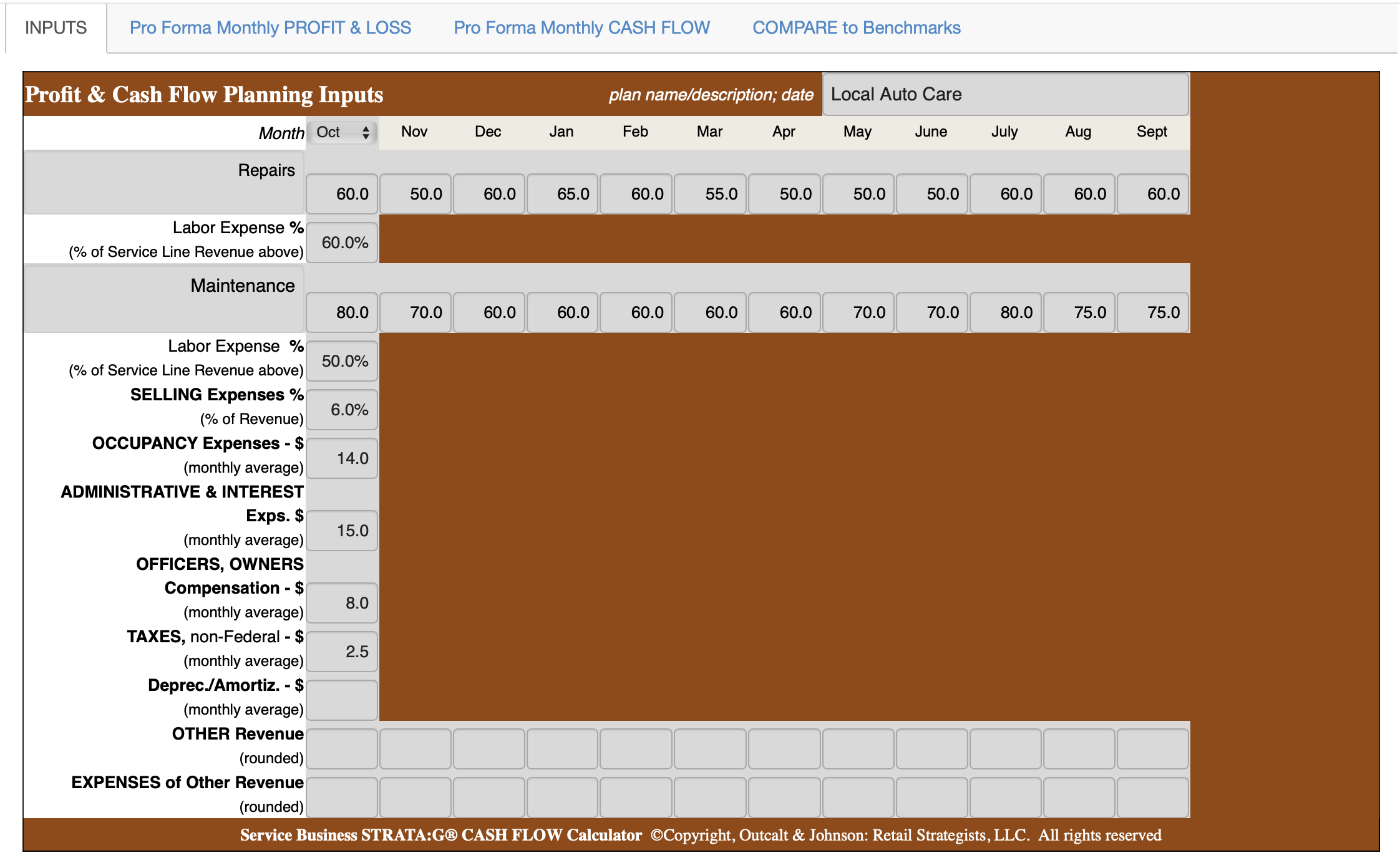

We started at the Inputs screen.

[Use these input numbers with the Strata:G Calculator for Service Businesses; test or validate"What if...?" ideas.]

- Using the owner’s budget, we entered estimated sales each month for both the Repairs and Maintenance departments.

- All other expenses have been sorted into “buckets.” Labor and selling expenses are treated as variable expenses; all others – Occupancy expenses; Admin & Interest expenses, Owners comp, Taxes, Depreciation – are fixed expenses.

- We need just one entry for each expense category, allowing quick calculation and comparison of all "what if...?" adjustments.

“Ready for the Big Picture of your budget?” I asked. The owner nodded.

I clicked to the pro forma Profit & Loss screen.

- “So here’s what that produces: $1.5 million in total sales. $680,000 is from Repairs at 60% labor, $820,000 from Maintenance at 50% labor.

- And, you can see your Expenses by bucket, and what each bucket represents as a percent of total sales.

- And here’s “the bottom line”: $118,000 in profit, about 7.9%.”

He leaned forward. “Well, that’s not great, but it’s at least positive.”

“True,” I said. “Before we make any changes here, to try to improve profits, let’s check the cash.”

We moved to the pro forma Cash Flow screen.

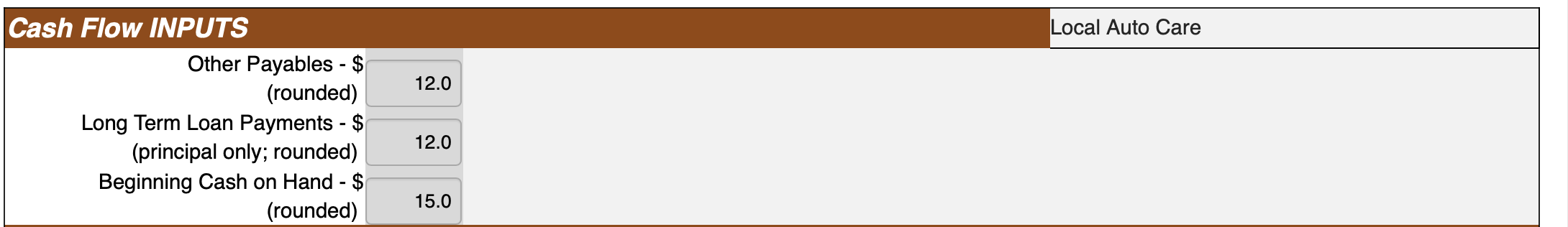

There were a couple more inputs to enter: payables, long term loan payments, and cash on hand.

Then we scrolled down the screen, noting all three sections: Cash Coming In, Cash Going Out, and the Difference.

And that last line in “the Difference” section - Ending Cash Balance each month - was sobering.

It dipped into red by month three, nearly $31,000 underwater by month nine, finishing the year at minus $23,000.

The owner rubbed his forehead.

“That explains it. Even with a profit, every fall I’m juggling bills, borrowing from the line, just trying to keep the wheels on. I knew it, but I didn’t know it looked like this.”

I nodded. “Exactly. On paper, profit looks fine. But in the bank? It’s negative. That’s the stress — you can’t pay bills with profit if cash is short.”

He sat back, quiet for a moment, really seeing the gap. The “aha” moment.

“Okay,” I said, after a pause. “What if we test an idea?”

He straightened up. “Sure. What do you have in mind?”

“You mentioned that new lift system,” I reminded him. “If you had it, you said one maintenance position could go. Let’s see what that does.”

I made the adjustments right in front of him:

- Assume you finance the new equipment over 3 years, so on the Cash Flow screen, we increase monthly loan payments by $2,000.

- Then, on the Inputs screen, increase Admin & Interest expense by $200 for the new note.

- And, still on the Inputs screen, change Maintenance labor from 50% down to 40%, to reflect the staff reduction.

Did that make any difference?

We went back to the pro forma P&L screen.

His eyebrows went up. “Profit jumps up? To almost $198,000? That’s a 13% margin!”

“Exactly,” I said, “and the sales haven’t changed one bit.”

We turned to the pro forma Cash Flow screen.

The negative numbers were gone.

“Look at this,” I said. “Every month, you stay positive. The lowest balance is about $6,000 mid-summer, and by year-end you’ve got $32,600 in cash.”

The owner just stared at the screen for a long beat. Then he grinned.

“That’s a completely different picture. Same shop, same customers — just with better equipment.”

“That’s the point,” I said. “You've been thinking about that new lift for a long time. But there was a lot of uncertainty about going ahead with it. Now, we don’t have to guess. We can test it right here, before you commit.”

He leaned back, thinking. “I want to get a quote on that lift. This feels real.”

“Perfect,” I said. “Let’s get the financing terms, plug them in here, and see exactly what the payments would do to your profit and cash flow. You’ll know the outcome before you sign anything.”

The Difference This Made – The Power of "Show, not tell."

What began as a stressful review of a shaky budget turned into a collaborative problem-solving session.

The owner saw his real pain point — profit on paper, but cash short in practice — and then saw, with his own eyes, how an investment in new equipment could transform both profit and cash.

That’s the power of Strata:G. Instead of just reviewing past financials with owners – and being worried about them – Strata:G lets us test the future together.

That offers a whole new dimension to my work with clients. Much more satisfying!