Assume that you are the outside bookkeeper for an engineering firm. You know that they are profitable, but are also aware that they increasingly have been late on payments (including your fees.)

The firm owner has asked you to start putting together a “profit plan” for the upcoming fiscal year. You decide to use the Strata:G® Financial Calculator for Professional Firms.

Here is how you used it in your meeting with the owner, and how the meeting unfolded.

---

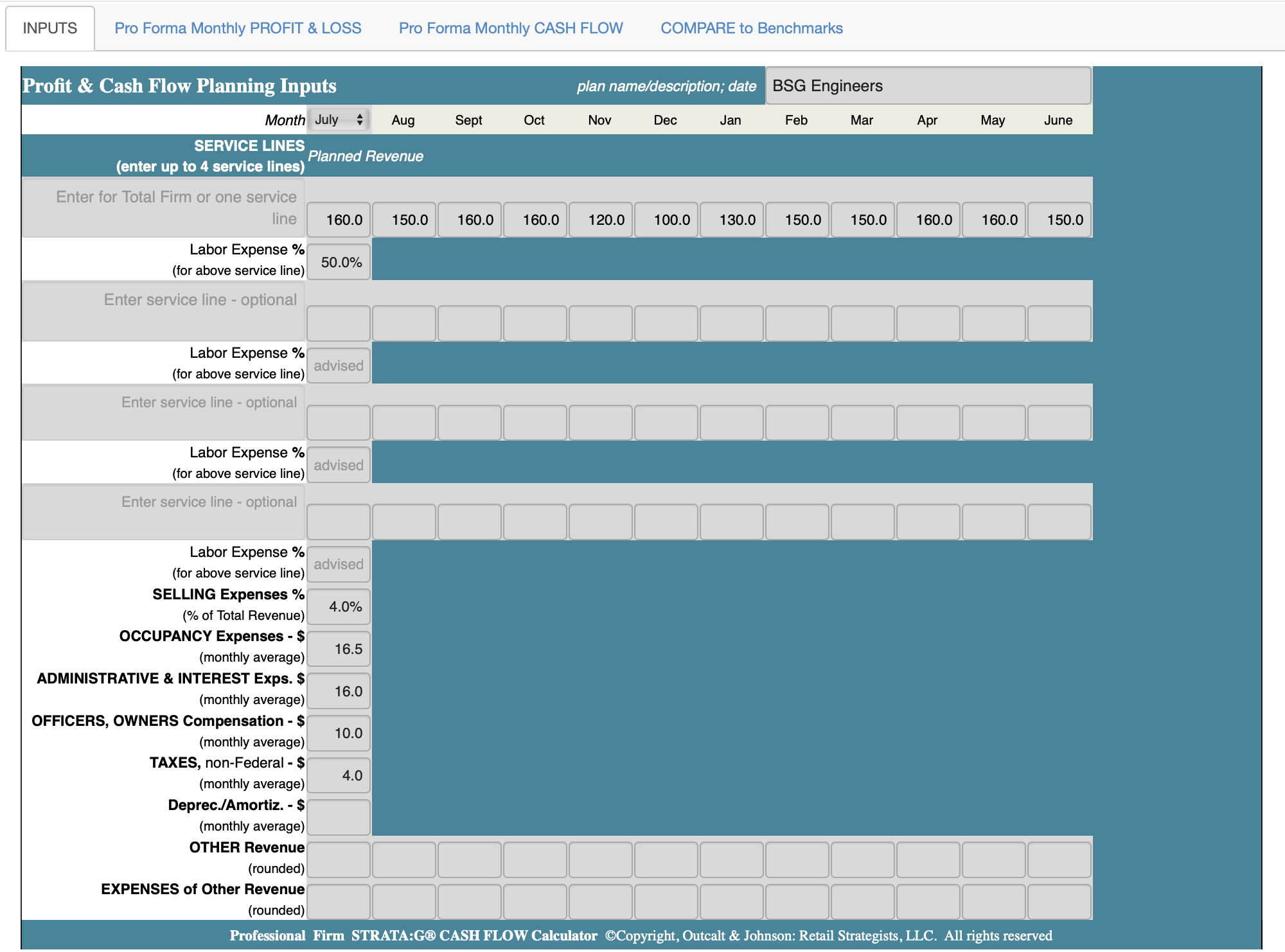

1. Start at the INPUTS Screen

[Use these input numbers with the Strata:G Calculator for Professional Firms; follow along to test or validate"What if...?" ideas.]

“I started with last year’s numbers, and used them for the inputs to the Strata:G Calculator. It’s built for this kind of Big Picture planning.”

A quick review with the client:

2. Show the pro forma PROFIT & LOSS screen

Immediately! See the outcome.

Even with those few inputs (from the previous screen), this projected P&L has a lot of useful management information on it.

- First, it projects 12 monthly P&Ls: revenue, expenses, and profit by month.

- Then, the 12-month line item totals

- And, it shows each of those 12-month totals - revenue, expenses, profit - as a percent of total revenue.

“The good news is, this plan shows solid profitability. Projecting Revenue of $1,750,000, with Labor expenses of 50%, Projected Operating Expenses would represent 85.9% of revenue. And that would generate a Pre-tax profit of $247,000, 14.1%."

“But let’s not stop there. Let’s also take a look at Cash Flow.”

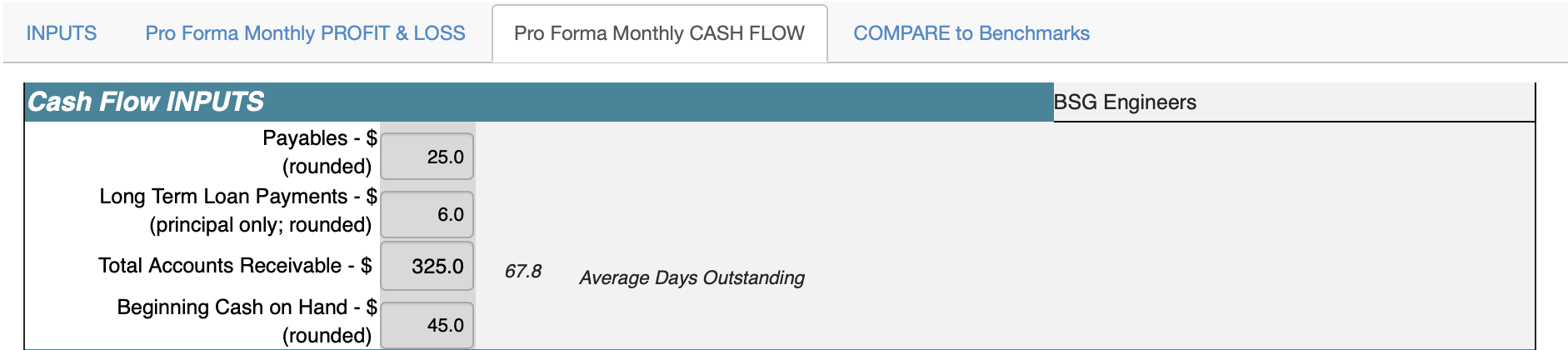

3. Show the pro forma monthly CASH FLOW screen

First, there are a couple more inputs. (We get them from the Balance Sheet.)

- Payables

- Long term loan payments

- Total accountants receivable

- Beginning cash on hand

Now, just scroll down through the three parts of a Cash Flow Plan: Cash Coming In, Cash Going Out, and The Difference, to the Ending Cash Balance for each month.

- The Ending Cash Flow balance line shows negative numbers.

- Despite the profit, the firm runs short of cash in 11 out of 12 months.

🔑 This discovery of a looming cash crisis can surprise a client. No need to comment. Let the client absorb it.

Then, "I know you get ideas all the time for 'improving' your business – from vendors, staff, family, even me!

"But now, we can see which of those ideas might "pencil out" for you. Then you can decide what to do, based on numbers, not just opinions."

"Ready to play 'What if...?'"

First, take a closer look at the Cash Flow screen.

Seems like two things are driving this:

- Loan payments of $6,000 a month — cash going out the door, even though it doesn’t show up on the P&L.

- Accounts receivable: $325,000 tied up, which equals nearly 68 days of sales. That means you’re basically floating two months of revenue while waiting to get paid.

(Pauses for owner reaction.)

Owner (likely):

“Yeah… our engineers are supposed to chase receivables, but they hate it. And honestly, they’re not very good at it.”

(Pauses again.)

"Well, let’s test a potential remedy. What if…you added a dedicated A/R manager?"

- Yes, it would increase admin costs.

- But – we also free up engineers to bill more work.

- And we reduce outstanding receivables.

"But you don't have to take my word for it; let's put it to the test. Let Strata:G show us what happens to profit and cash."

Go to Inputs screen:

- Adjust Admin costs: +$8,600/month for salary, benefits, and software.

- Adjust Engineers’ labor expense to 40% (they’re not spending time on A/R.)

Go to Cash Flow screen:

- Reduce A/Rs to $175,000 by dedicated person speeding collections.

See immediately: Did that make a difference?

- Go to P&L screen: “Look at this: Profit margin improves from 14% to 18%. That’s an extra $60,000+ to the bottom line.”

- Go to Cash Flow screen: “Now, look at the Ending Cash Balance line. Cash flow goes positive every month!”

(Pauses, lets the owner absorb the difference.)

Owner (likely):

“So by hiring one admin person, not only do we avoid cash crunches, but we actually make more money?!”

That's Strata:G's power of "Show, not tell"

Two key takeaways:

- The firm doesn’t have a profitability problem — it has a cash flow management problem.

- Strata-G shows us the real problem – and then lets us test potential remedies before you commit.

–––

Bookkeeper/Accountant role: Not to prescribe, but to show and explore.

Client role: To react, weigh trade-offs, and decide.

Strata:G’s role: The objective referee—instantly show the financial consequences.